Hello UK Landlords and Property Investors,

The UK property market is on the cusp of transformation, driven by a recent reduction in interest rates. This pivotal shift is reinvigorating the market, creating new opportunities for landlords and investors alike. Whether you’re managing rental properties or expanding your portfolio, understanding how these changes impact your bottom line is crucial. Let’s explore how this new landscape could enhance your investment strategy and boost your returns.

What’s Happening in the UK Property Investment Market?

Right now, the UK property market is experiencing a wave of cautious optimism. After enduring a period of higher interest rates aimed at curbing inflation, we’ve recently seen a welcome reduction. This shift is infusing the market with fresh momentum. The average new seller’s asking prices fell recently, reflecting market conditions and providing insight into seller sentiment amid changing interest rates and a shifting housing market. Property prices are beginning to stabilize, and transaction volumes are starting to show signs of recovery. The UK housing market, with comprehensive data collected from various national registries, offers a wider perspective but may have a potential time lag in data processing and updates. In fact, Nationwide Building Society reported a 1.7% increase in house prices in July 2024, marking the first monthly rise since March.

How Does This Affect You?

For Landlords: Making the Most of Lower Rates

Lower Financing Costs: The drop in interest rates is great news for landlords with variable-rate mortgages. With reduced monthly payments, there’s more cash flow to reinvest or improve profitability. However, it’s important to remember that mortgage repayments are part of the ongoing costs landlords must consider, alongside other expenses such as ground rent, service charges, and maintenance costs. According to UK Finance, the average interest rate on a two-year fixed mortgage has fallen to 1.9% in Q2 2024. This reduction directly boosts your bottom line, offering more flexibility in managing your property portfolio.

Rising Property Values: Historically, lower interest rates often lead to increased property values as cheaper borrowing fuels demand. The Halifax House Price Index shows property values have surged by 9.2% annually in response to recent rate cuts. If you own property, this could mean a significant increase in your assets’ value.

Rental Yields Under the Spotlight: While rising property values are good news, there’s a potential downside—rental yields might get squeezed if rents don’t rise at the same pace. However, the UK rental market remains strong, with a chronic undersupply of rental properties. According to HomeLet, average rents have risen by 4.8% year-on-year as of July 2024. With lower financing costs, your overall returns are likely to improve, even in this competitive market.

For Investors: Seizing New Opportunities

Time to Expand Your Portfolio: With borrowing costs down, now is an ideal time to think about expanding your property portfolio. The Royal Institution of Chartered Surveyors (RICS) reports an increase in buyer inquiries by 36% in July 2024, showing a clear correlation between lower interest rates and heightened investment activity.

Strategic Reassessment: It’s a perfect moment to revisit and fine-tune your investment strategy. Look closely at areas benefiting from lower rates, particularly urban centres like Manchester and Birmingham, where demand is robust and growth prospects are promising. These hotspots are seeing property price growth that outpaces the national average, presenting lucrative opportunities for savvy investors. Additionally, consider property development as a potential investment strategy, focusing on refurbishing and modernizing old properties. This approach comes with its own set of risks and rewards, which should be carefully evaluated.

What History Tells Us

We can learn a lot from history. When the Bank of England slashed interest rates during the 2008 financial crisis, it helped stabilize the housing market, leading to a recovery that saw home prices rise by about 5% annually from 2010 to 2014 (Office for National Statistics). The HM Land Registry plays a crucial role in collecting property sales data for the UK’s official House Price Index (HPI), recording all property sale completions in England and Wales.

Today’s scenario mirrors those conditions. The recent rate cuts are likely to have a stabilizing effect, with UK house prices showing resilience—annual growth reached 2.6% as of June 2024, according to the Office for National Statistics. The land registry is essential in tracking property sales and calculating house price indices, providing insights into the current market landscape.

Understanding Current Inflation Dynamics

Inflation is a key factor to watch. Back in 2021, inflation was driven by supply chain disruptions and pandemic-related factors. Now, it’s heavily influenced by housing costs. The Office for National Statistics (ONS) highlights that housing and household services have been major contributors to recent CPI increases. Understanding this shift is crucial for anyone invested in property, as it underscores the housing market’s critical role in broader economic conditions. Property bonds are another indirect investment method in real estate, offering a way to pool funds and leverage investments alongside property trusts and REITs.

Rental income is a significant revenue stream in property investment, impacting the overall return on investment. It is essential to understand how rental income can meet mortgage obligations in buy-to-let scenarios and contribute to the earnings of real estate investment trusts (REITs).

Current UK Interest Rates: Where Do We Stand?

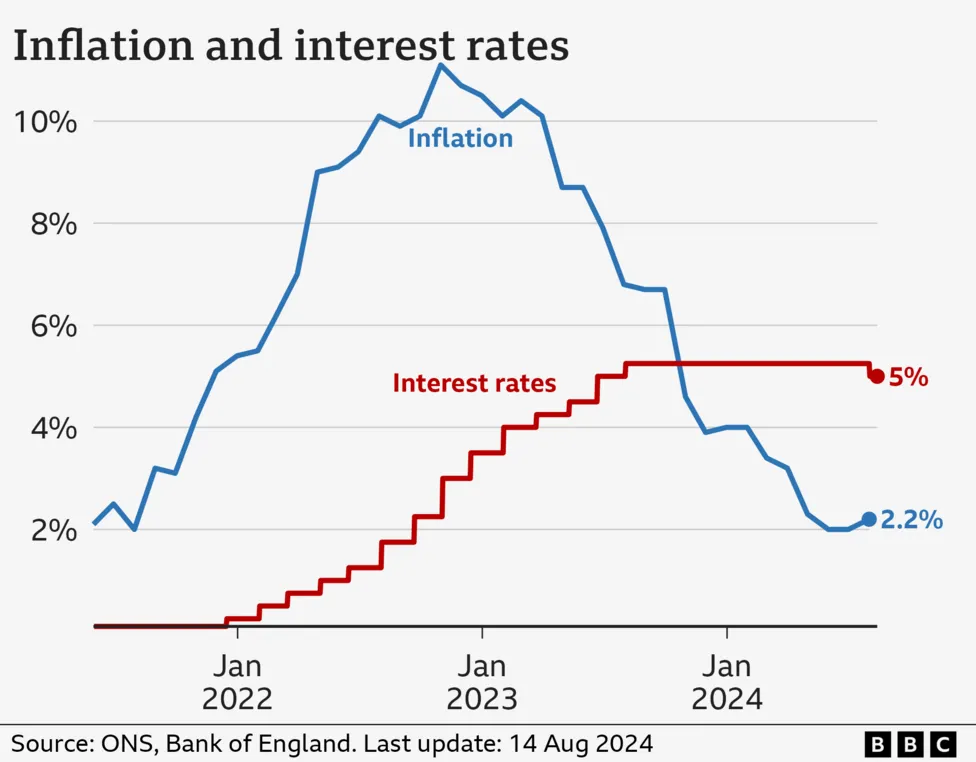

As of August 2024, the Bank of England has set the base interest rate at 4.25%, down from a peak of 5.25% earlier in the year. This reduction follows signs of cooling inflation, with the CPI falling to 6.3% in July 2024 from 7.9% in May.

What to Expect Moving Forward

Interest Rates and Inflation: What Lies Ahead

The International Monetary Fund (IMF) has suggested that UK interest rates could drop to 3.5% by the end of 2025. If inflation continues to ease, we may see further rate reductions. Most economists agree that we’re entering a period of relatively stable, low interest rates, though this will be closely tied to inflation trends. This environment presents a unique opportunity for investors to lock in favourable deals, with improving prospects for both property values and rental incomes. Various options within the realm of property investments, such as residential, commercial, and industrial properties, offer different strategies for getting started, including renovation or purchasing during the construction phase.

UK residential research indicates potential increases in property values influenced by factors such as interest rate changes and broader economic conditions.

Conclusion: Time to Act

The reduction in interest rates marks a pivotal moment for the UK property market. For landlords and investors, this is your chance to optimize financing, expand your portfolio, and position yourself for future gains. If you’re a first-time buyer, the improved affordability could make now the ideal time to step onto the property ladder. Additionally, exploring property investing, whether domestically or abroad, can offer potential benefits such as rental income, but it is crucial to conduct thorough research and financial assessment.

Stay informed, stay proactive, and make the most of these evolving market conditions. Understanding the dynamics at play will help you make strategic decisions and capitalize on the opportunities that 2024 has to offer.

If you have any questions or want to discuss how these changes affect your specific situation, please get in touch. We’re here to help you navigate the landscape and seize the opportunities ahead.